Table of Contents

Support for Tradtional Trading Styles

This bundle brings together 4 components to benefit the Traditional/Technical Analysis trader: the Chart Tool TA, the Session Tool, the Snapback, and the Price Direction Pressure Index.

The Chart Tool TA can find and mark on your charts:

-

Swing Highs and Lows

-

Basing Candles

-

Base Highs and Lows

-

Candle in Control High and Low

-

Segments

-

Trend (Major and Minor)

Additional features:

-

Supports Optimized Settings Files (OSF files)

-

Can use Pro OSF files for pre-canned configurations

Swing Highs and Lows

-

Swing Highs are indicated by placing a red dot above the swing high candle

-

Swing Lows are indicated by placing a green dot below the swing low candles

-

The size, color, and position of the dots used to mark swings are user configurable

Basing Candles, Base Highs, Base Lows

-

Basing Candles

-

Are marked on the chart with a tick mark in the center of the candle. The default color for the tick mark is yellow, but the user can select any supported color.

-

The user can choose to mark all basing candles or only those which are not nested.

-

-

Base Highs and Lows

-

Base Highs are marked with dashed red line.

-

When a base high is broken, its color can be changed (magenta is used in the example) or it can be removed from the chart.

-

Base Lows are marked with a dashed green line.

-

When a base low is broken, its color can be changed (cyan is used in the example) or it can be removed from the chart.

-

The length of the marker line used for a Base High or Base Low is determined by the length of the base that was broken.

-

Candle in Control High and Low

-

Candle in Control High and Low

-

Marked on the chart using a text label

-

User can control the color, font, and font size of the labels

-

-

Updated dynamically as market conditions change

-

An alert can be generated when either the CIC High or CIC Low changes

-

Segments

-

Segments form the low level trend (microtrend) for the chart

-

Can be shown on the chart using trend lines or Bull & Bear boxes

-

If shown using trend lines then

-

A segment can be labeled with its length

-

The average length and/or standard deviation in length for segments of the same type can be included in the label

-

Segments with unusually long or short lengths can be automatically identified and are indicated by changing the color of their labels

-

Trend

-

The impulse and corrective moves of the major trend for the interval can be marked using trend lines, Bull &Bear boxes, or both

-

If shown using lines, then

-

An impulse or corrective move can be labeled with its length

-

The average length and/or standard deviation in length for impulse/corrections of the same type can be included in the label

-

Unusually long or short impulse/corrections can be automatically identified and are indicated by changing the color of their labels

-

OSF File Support

-

Supports Optimized Settings Files (OSF files)

-

Can use Pro OSF files for pre-canned configurations

-

Personalize your Charts

-

Combine Chart Tool features to create the charts you need!

-

Display just the information you want or need for the strategies you are using

-

Customize the look and feel of your charts to convey information as quickly and easily as possible

Spend less time charting and more time on other aspects of your trading!

The Session Tool can be used to provide the trader with pertinent information to assist with strategies and reduce the time spent on charting

The Session Tool allows the user to define a session to be displayed on their chart.

-

A session is a period of time during the day, and all candles which close during that time are considered to be part of the session.

-

A session may correspond to a real world entity (such as the time period when the stock market is open), or it may be something which has no correlation to any real world entity or event that the user has created for their own use (such as for open range breakouts). So the definition and meaning of a session is entirely up to the user.

The Session Tool is capable of collecting some statistics about a session, such as:

-

The range of the session

-

The average and standard deviation of range for sessions

-

The length, average, and standard deviation of the distance from the open to the high for sessions

-

The length, average, and standard deviation of the distance from the open to the low for sessions

These statistics can be used to predict possible behavior for future sessions, or be used for other purposes, such as calculating a value for a strategy.

The Session Tool can be used to project lines on the user’s chart.

-

These lines may be for reference (such as prior daily/weekly/monthly/yearly highs and lows) or be calculated values for use with a strategy.

-

Alerts can be generated when these lines are crossed.

The Session Tool supports OSF files.

-

The Session Tool can use Pro OSF files. Pro OSF can be used to configure the Session Tool for use with a specific strategy or trading style.

What is a Session?

-

The Session Tool allows the user to define a session to be displayed on their chart.

-

A session is a period of time during the trading day, and all candles which close during that time are considered to be part of the session.

-

A session may correspond to a real world entity (such as the time period when the stock market is open), or it may be something which has no correlation to any real world entity or event that the user has created for their own use (such as for open range breakouts). So the definition and meaning of a session are entirely up to the user.

-

The Session Tool is capable of collecting some statistics about a session:

-

The range of the session

-

The average and standard deviation of range for sessions

-

The length, average, and standard deviation of the distance from the open to the high for sessions

-

The length, average, and standard deviation of the distance from the open to the low for sessions

-

These statistics can be used to predict possible behavior for future sessions, or be used for other purposes, such as calculating a value for a strategy.

Projecting Lines on a Chart

-

The Session Tool can be used to project lines on the user’s chart.

-

These lines may be for reference (such as prior daily/weekly/monthly/yearly highs and lows) or be calculated values for use with a strategy.

-

Alerts can be generated when these lines are crossed.

-

-

Overall, the Session Tool can be used to provide the trader with pertinent reference information, to assist the trader with certain strategies, and to reduce the time spent on charting.

OSF File Support

-

Supports Optimized Settings Files (OSF files)

-

Can use Pro OSF files for pre-canned configurations

-

The user has the ability to control the loading and use of Pro OSF files.

-

The user has the ability to override any setting configured by a Pro OSF file.

-

Exploit "Reversion to the Mean" with Advanced Analytical Capabilities

-

The Snapback Indicator is based upon the concept of "Reversion to the Mean." The basic idea is that price tends to stay near an average value. This average value may change over time, but the average changes at a rate that is slower than what price can do. If price suddenly moves well away from the current average value, then price will move in a way to reduce the distance between itself and the current average.

-

The two most common behaviors we see when price has opened a large gap between itself and its current average, are the snapback and the stall:

-

A snapback occurs when price stops moving away from its current average and instead moves back towards it, often touching or crossing the average.

-

A stall occurs when price moves sideways and waits for the average to close the gap by catching up to price.

-

Unidirectional Mode

-

The Snapback Indicator creates a histogram where the height of the bars in the histogram represent how far away from the mean price currently is. The color of the bars in the histogram indicate how unusual it is for price to be that distance from the mean.

-

Green bars indicate that price is within 1 standard deviation of the mean. This is the “comfort” zone where price normally likes to stay.

-

Yellow bars indicate that price has left the “comfort” zone and is between 1 and 2 standard deviations away from the mean. When the bars are yellow, it is possible to get a snapback or stall.

-

Red bars indicate that price is well away from the “comfort” zone and is between 2 and 3 standard deviations away from the mean. Red bars typically mean that a snapback or stall is likely to happen soon.

-

Magenta bars indicate that price is more than 3 standard deviations from the mean. This is very unusual (extreme!) and typically means that a snapback or stall is almost certainly coming, its just a matter of when.

-

Bidirectional Mode

-

The Snapback Histogram can be displayed in either Unidirectional mode or Bidirectional mode.

-

In Unidirectional Mode, all of the bars point in the same direction and show how far price is from the mean. It does not indicate whether price is above or below the mean.

-

In Bidirectional Mode, the bars of the histogram point in the direction that price will move if a snapback occurs. The bars still show how far price is from the mean, but they now take into account whether price is above or below the mean.

-

In either mode, a signal line may optionally be generated using a moving average of the height of the bars.

In Use

-

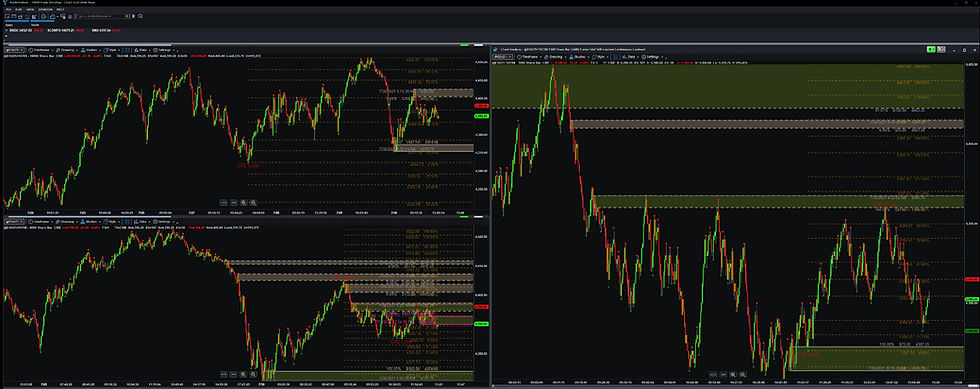

This chart shows the Snapback indicator in use on the ES (futures) on a 5 minute interval.

-

The Snapback Indicator is set to track the distance from price to the mean as a multiple of the ATR. This helps to adjust for changes in volatility during the trading day.

-

The signal line is turned off.

-

The warn if above line is active and is set to 2. If the distance from price to the mean is above 2 ATR (which means the mean is 2 ATR or more above price), then an alert will be generated.

-

The warn if below line is set to -2. If the distance from price to the mean is below -2 ATR (which means the mean is 2 ATR or more below price), then an alert will be generated.

Snapback Scan

-

The Snapback Scan Indicator is a version of the Snapback

Indicator which is designed to operate in a TradeStation® RadarScreen® or Scan. -

By user request, it contains some additional settings not found in the Snapback Indicator which allow the user to tweak the internal workings of the indicator.

-

The Snapback Scan Indicator is intended to be used in conjunction with the Trade Finder, Pattern Finder, and Chart Tool, where it can act as an odds enhancer for the bands or patterns found by those tools.

The Price Direction Pressure Index (PDPI) is an indicator that examines price movement both within candles and between candles.

The price movement it finds is characterized as either upward or downward movement.

-

The upward movement and downward movement are processed independently of each other and can be displayed independently, together, or as a composite index.

-

The values displayed can be either raw or as an index with a range of 0 to 100.

-

Statistics are used to convert raw values to index values when index values are required.

When the PDPI is showing the composite index, values below 50 indicate that there is more pressure on price to go down than up, and values over 50 indicate that there is more pressure on price to go up than down. The PDPI is primarily used on Time based, Tick based, or Share based charts.

The Composite Index

-

The PDPI in use on the NO (futures) for 12-20-2023 on a 1597 tick chart.

-

Some areas of divergence have been marked.

-

Divergence is usually a sign that support for the current move in price is changing.

Upward & Downward Pressure

-

The PDPI in use on the NQ (futures) for 12-20-2023 on a 1597 tick chart.

-

In this example, the PDPI is showing the upward (green) and downward (red) pressure individually.

Combined Display

-

The PDPI in use on the MNQ (futures) for 3-27- 2024 on a 987 tick chart.

-

In this example, the PDPI is showing the up pressure index (dark solid green line), down pressure index (solid red line), and the composite pressure index (light green dot-dash line) as well as some divergences. The divergences show that the support for the current price move is changing.

Is the TA Edition Right for me?

Our TA Edition is right for you if you are a traditional technical trader.

The TA Edition automates finding many of the things used in technical trading like Trend (Major and Minor), Swing Highs and Swing Lows, Basing candles, Base Highs and Base Lows, and the Candle in Control (CIC) High and Low. It also includes Trend Analysis, Reversion to the Mean analysis, Price Direction analysis, and Session analysis. So, if you are a traditional trader that uses any of these items then the TA Edition may be right for you.

Also, please feel free to join us in The Foundry . The Foundry is free and is open to all traders for trading related activities.

Explore Other Editions

Answers to your questions

Here are some answers to commonly asked questions:

How do I get started?

To get started, you should register on the website . Before selecting a Tools for Traders edition, you may wish to attend one or more of the Tools for Traders Public Forums where you can see the Tools in action, ask questions, and meet the Community. These are held in The Foundry and are listed on the Community Events Calendar . The Foundry is free and open to all traders for trading related activities.

What tools do you offer?

We offer a range of leading edge tools which provide pertinent information and real-time market analysis which can be customized to support your trading strategies.

Is my data secure?

Yes, we take data security seriously. We use industry-standard encryption and follow strict privacy protocols to ensure the safety and confidentiality of your information.

Can I cancel my subscription?

Monthly subscriptions can be canceled. A monthly subscription should be canceled at least 48 hours before the renewal date to allow for proper processing. Yearly subscriptions, due to the discounts given, are paid in full in advance and can not be canceled.